The Economy

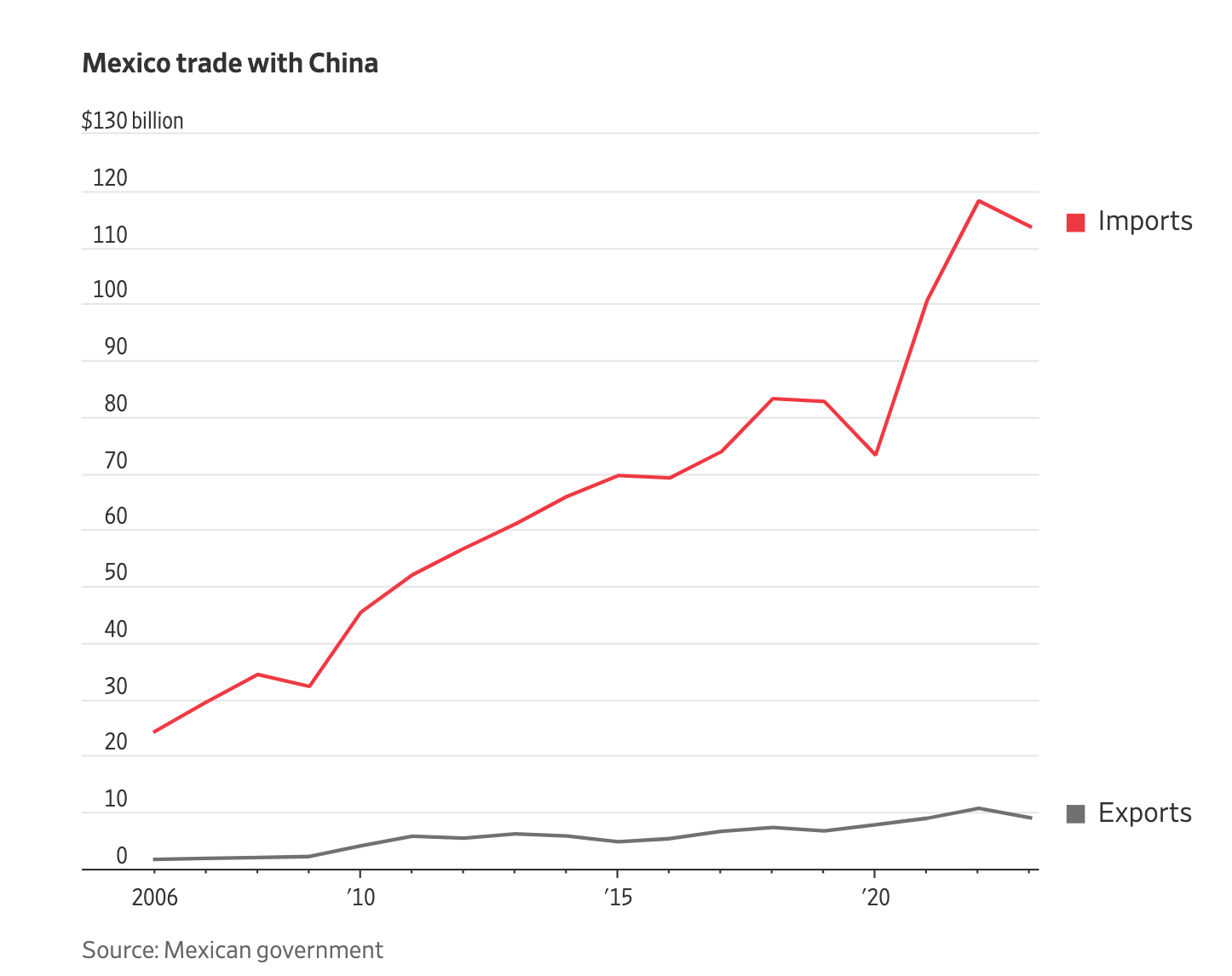

Mexico Looks To Domesticate

Mexico is intensifying efforts to reduce its dependence on imports from China by urging some of the world's largest manufacturers operating within its borders to identify Chinese products and components that could be produced locally. By shifting just 10% of Chinese imports to local production, Mexico could potentially boost its GDP by 1.4 percentage points and create approximately 560,000 new jobs. Key sectors targeted for this transition include medical devices, electronics, and auto parts. Compared to its rival China, Mexico has continued to expand its exports to the US but has struggled to attract foreign capital from companies looking to move manufacturing out of China. According to Mexico, the move will stabilize supply chains for its partners in North America, but stakeholders are concerned about execution - It may take decades for Mexico to develop supply chains and Mexico lacks the basic infrastructure to substitute some Chinese goods. The government is collaborating with established companies to assess the feasibility and develop plans for local manufacturing and will continue to raise the issue as the US-Mexico-Canada trade agreement is reviewed and current concerns are alleviated.

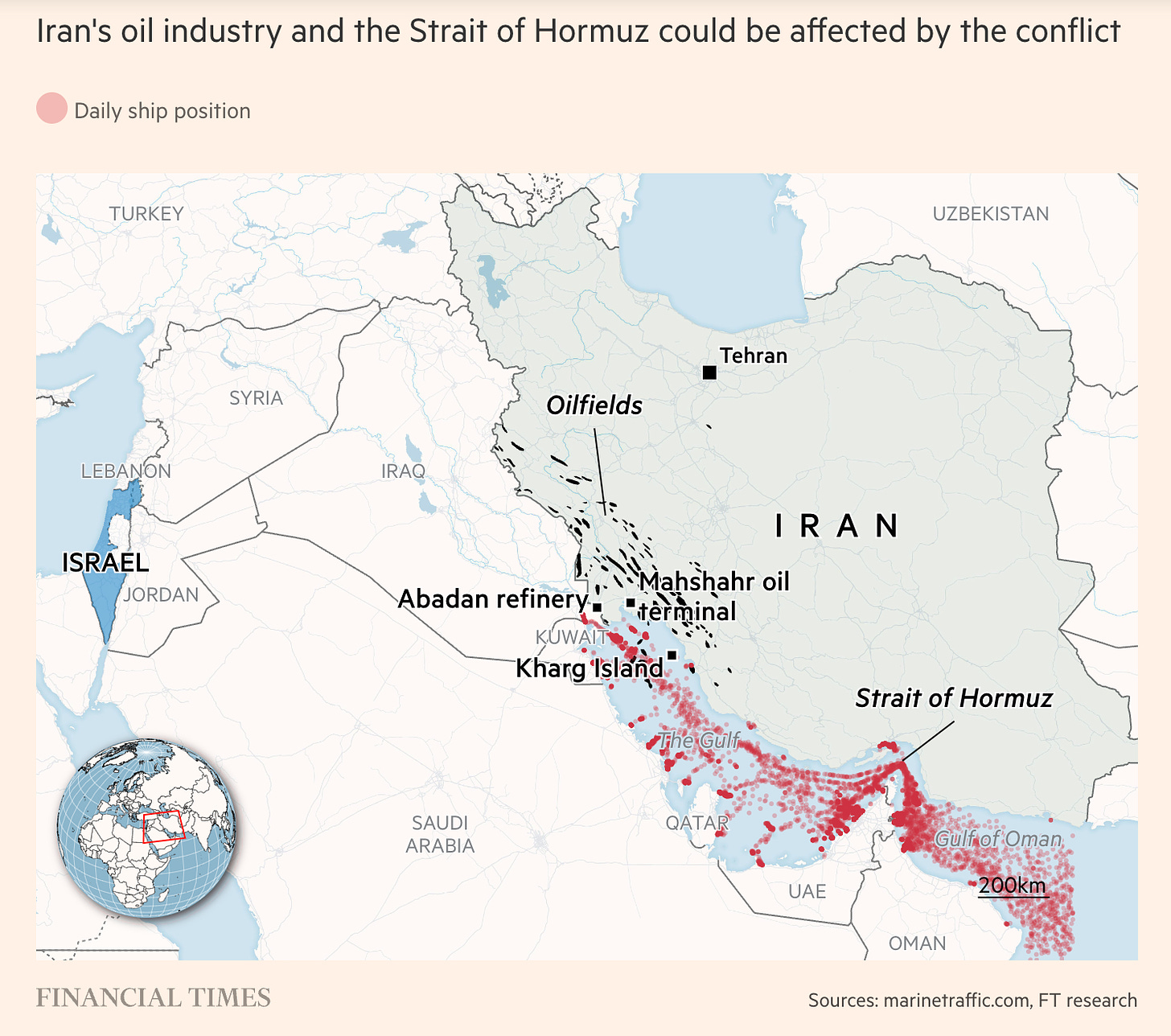

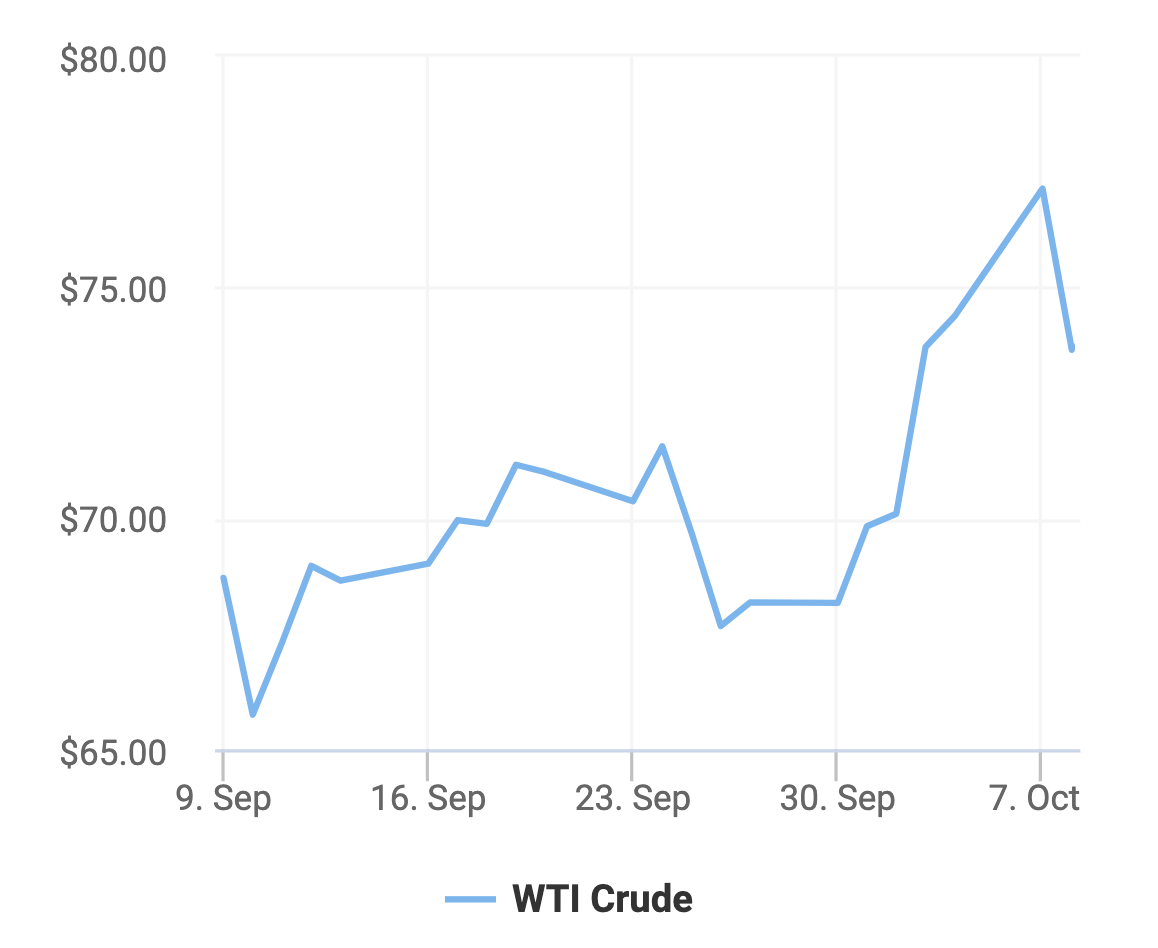

Oil Prices Surge As ME Conflict Ensues

The recent surge in oil prices has sent shockwaves through the global economy, with Brent crude reaching its highest weekly rise in almost two years and crude oil futures being sold off by investors. The price spike is primarily attributed to geopolitical tensions in the Middle East, particularly the ongoing conflict between Israel and Hamas, as well as recent production cuts by major oil-exporting countries like Saudi Arabia and Russia. The Islamic Republic of Iran exports 1.7m barrels of oil a day, and disruption via an attack would hinder global efforts to return to a post-COVID normal. Looking ahead, while some analysts predict that prices could reach $200 per barrel if the conflict in the Middle East escalates, others believe that the current price levels may not be sustainable in the long term. Factors such as slowing global economic growth and the ongoing transition to renewable energy sources could potentially cap oil demand and prices. The global economy is less dependent on oil than it was during previous price shocks, and many countries have diversified their energy sources. Additionally, since the OPEC production cuts, Saudi Arabia and the UAE have more than 5m barrels a day of spare capacity, which could be brought online to stabilize the market.

Equity Markets

Chinese Equities Rise & Fall

The Chinese stock market recently experienced a dramatic surge followed by a swift reversal, reflecting the complex economic challenges facing the world's second-largest economy. The rally was initially sparked by aggressive monetary stimulus measures announced by Chinese authorities, including interest rate cuts, lower reserve requirements for banks, and reduced mortgage down payments. These policies come after a prolonged deflationary spiral in the Chinese economy, consisting of a long property slump and depressed consumer spending. The announcement led to a significant influx of capital into Chinese equities, particularly in the real estate and consumer staples sectors as investors showcased their excitement in Chinese equities. However, the enthusiasm was short-lived. Investors were expecting greater fiscal spending to complement monetary policy, however, a recent press briefing needed to provide more information to make investors comfortable. The blue-chip CSI 300 index of Shanghai- and Shenzhen-listed stocks surged 10.8% before declining to close 5.9% higher. Whilst high valuations in the US have made Chinese equities more persuasive, the sudden reversal highlights the ongoing challenges investing in the Chinese economy, such as deflation, a downturn in the housing market, and elevated unemployment levels.

Bond Markets

Long-Dated Treasury Yields Continue to Rise Amid Uncertainty

Yields on long-dated U.S. Treasuries have been steadily increasing since the Federal Reserve's last meeting, defying expectations. Despite the Fed’s 50 basis point rate cut and declining short-term rates, 10-year Treasury yields have surged, driven by several potential factors. Analysts point to a strong U.S. jobs report and other robust economic data, which have reduced fears of a recession. This has made Treasuries less appealing, as investors shift toward riskier assets like equities and corporate bonds. Some experts also suggest the market is concerned that the Fed might be cutting rates too aggressively, potentially leading to higher rates next year. Rising oil prices, contributing to inflation concerns, are also adding pressure. Additionally, market volatility around interest rates could be pushing both real and nominal yields higher, signaling uncertainty as the Fed adjusts its policy in a post-pandemic environment. The 10-year treasury has now risen to 4% and the 2-year has also been rising fast, suggesting that the market is worried about inflation, and whether or not the Fed will be able to continue to cut rates given the threat of inflation.

Financial Services (IB/PE/HF)

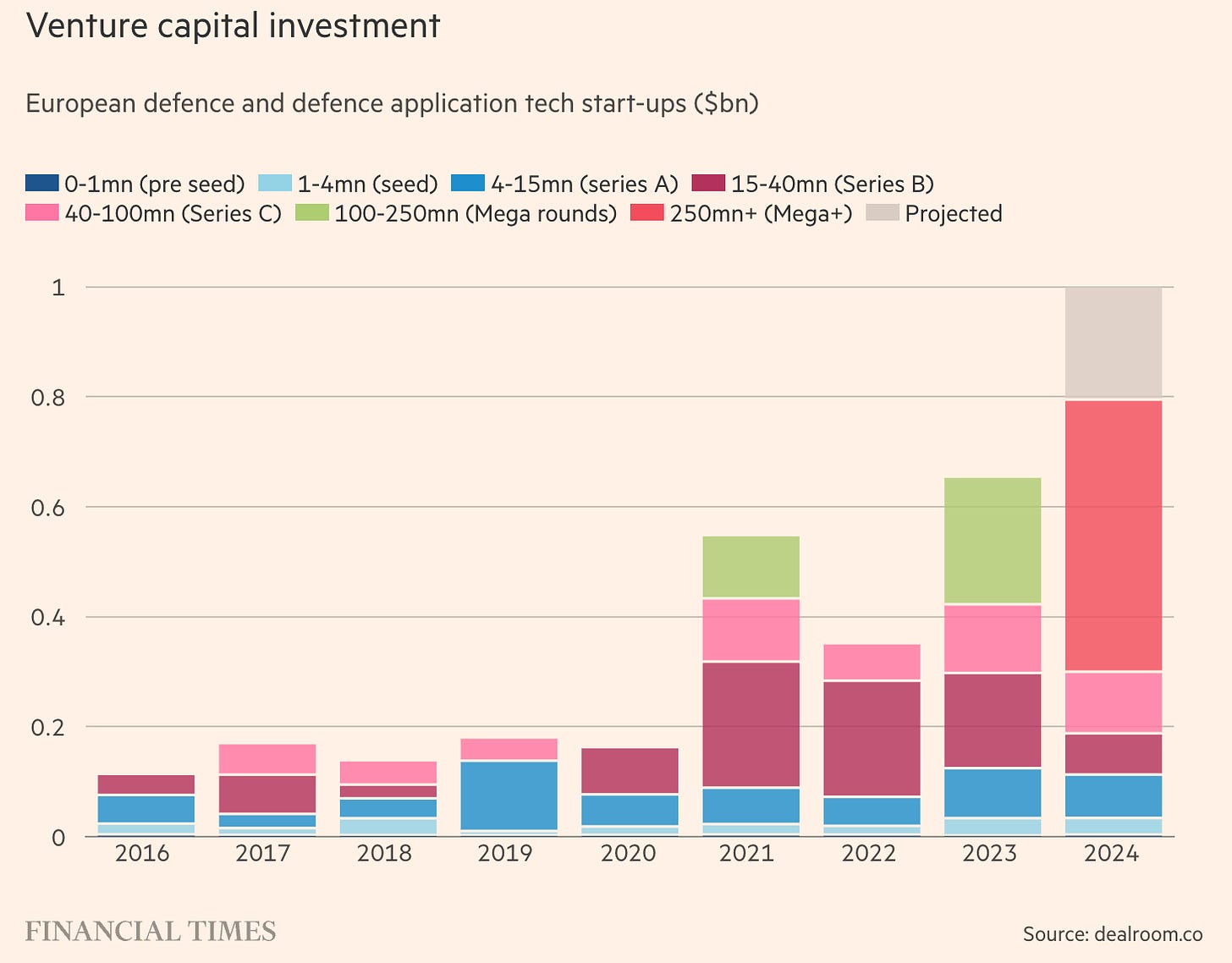

European Defenses Ramp Up

The European defense technology sector is experiencing a significant boost, largely driven by increased funding from the United States as concerns grow about global security and the need for advanced military capabilities. U.S. investors, including venture capital firms and defense contractors, are pouring millions into European military startups, recognizing the potential for innovative solutions in areas such as artificial intelligence, robotics, and cybersecurity. Startups across the continent, from France to Estonia, are benefiting from this investment surge, with many securing substantial funding rounds. The increased U.S. interest is partly motivated by a desire to strengthen NATO allies' defense capabilities and to gain access to cutting-edge European technologies. However, this trend is also raising questions about the long-term implications for European strategic autonomy and the balance of transatlantic defense cooperation. As these startups grow and potentially become acquisition targets for larger U.S. defense firms, European policymakers are grappling with how to maintain control over critical defense technologies while still benefiting from international investment and collaboration. Startups also face the challenge of navigating the extra difficulties of the defense sector — procurement, lobbying, export controls, or security-cleared talent across multiple countries and languages.

Transactional Activity

Apollo Adds To Its Manufacturing Portfolio

Apollo Global Management has agreed to acquire Barnes Group Inc. in a deal valued at approximately $3.6 billion, marking a significant move in the aerospace and industrial manufacturing sector. The all-cash transaction will see Apollo paying $47.50 per share for Barnes, representing a premium of about 22% over the company's closing price on June 25.

Barnes Group Inc. is a global provider of highly engineered products and differentiated industrial technologies, primarily serving the aerospace and industrial sectors. In the aerospace segment, Barnes supplies precision-engineered components to commercial and military aviation whilst in the industrial segment, the business manufactures a diverse array of components to industries such as automotive, consumer goods, and energy.

The acquisition comes at an interesting time as Barnes recently posted a net loss of $46.8 million in the second quarter of 2024, with revenue of $382.2 million, which missed analysts' expectations. With the acquisition, Apollo will be thinking long-term as it looks to take advantage of increasing demand in manufacturing and aerospace trends at a time when travel demand is surging.